ZAMZAM :GREAT BANKING.

- ZamZam represents a progressive system of fair financial agreements between individuals and organizations based on the Islamic banking model. Our principles: honesty, transparency, ease of use and full control over money for consumers. This decision was made possible thanks to the emergence of blockchain technology and the cryptocurrency market. Nevertheless, the main obstacle to the formation of a full-fledged ecosystem is the insufficient number of cryptocurrency users and the complexity of its use. ZamZam expanding global audience of users of cryptocurrencies, attracting mass that is not adherent technologies. ZamZam service allows you to send cryptocurrency anywhere in the world, even if the recipient does not have a cryptocurrency wallet. To do this, simply enter the phone number to which the recipient will receive an SMS with a link to download the application. After a simple authorization procedure and the authenticity of their identity, the user will be able to manage the funds received. The service is simple, transparent and democratic.

- ZamZam is a transparent, fair and efficient blockchain Bank that unites millions of people and organizations in the cryptocurrency market. This will give users the ability to control cash flow and taxation and allow users to save millions of dollars on transactions while maintaining full control over their funds. Unfortunately, commissions on the payment market p2p remain quite high. Currency conversion and high fees of banks and payment systems make p2p transfers unnecessarily expensive. At the same time, 31% of the world's population does not have a Bank account. ZamZam will work to solve these problems, make p2p transfers as accessible as possible, and help millions of people who don't have access to a strengthened financial services Bank account.

- Zam.wallet is a secure, multi-functional wallet with a user-friendly and functional interface. It plays a key role in the ZamZam ecosystem. ZamZam Bank will support most of the default cryptocurrencies, including Bitcoin, Ethereum (including ERC20 tokens) for all payment related features. This not only means that customers will be able to store and exchange these currencies, but also gives them the ability to keep balances on accounts linked to payment cards, allowing users to hold cryptocurrency just like regular money.

- ABOUT THE MONSIEUR HIMSELF :NAMIG MAMEDOV.

- Namig Mamedov — New technical advisor to Zamzam

- Namig Mamedov is a businessman, patron and public figure who initiated a large number of regional, national and international projects. He made his way from a computer setup technician at Marko Computer Technologies to the chairman of the Board of the international Caspel holding. He worked as IBM representative in Azerbaijan. He is fluent in Turkish, Azerbaijani, Russian and English.

- Namig Mamedov’s projects allowed to improve the quality of the communication system in Azerbaijan, and today the majority of the country’s branch networks and state institutions operate on the basis of this network.

- Under his leadership, decisions were developed for the Tax Inspectorate of the Republic of Azerbaijan, including the initiation of a project to centralize and unify all tax reports on TIN(2002–2003),within which a private data transmission network was established along with AVIS, the first Automated Tax Information System in Azerbaijan(2004–2006).

- Other projects:

- 2006 — Single Registration Window to simplify the process of registration of commercial enterprises;

- 2007 — project for the installation of a videoconferencing system covering all subjects of the Ministry of Taxes, regional divisions and departments;

- 2008 — electronic declaration system, thanks to which legal entities and individuals have been sending all of their declarations only in electronic form since 2008.

- In subsequent years, Mamedov initiated more than 10 projects, which significantly improved, first of all, the organization of work of state institutions of Azerbaijan, and also made a significant contribution to business development.

- By the decree of the President of Azerbaijan on February 6, 2014, Namig Mamedov was awarded the Tereggi medal.

- In Zamzam, Namig Mammadov is in charge of developing strategic partnerships that include the implementation of a tax hub, as well as supporting the further growth and development of Zamzam and its expansion into the Azerbaijani market, establishing contacts with the presidents of various companies, participating in key decisions, thus making an invaluable contribution to development of the project and contributing his vast experience to its development.

- Zam.exchange

- Zam.exchange is an intelligent currency conversion system that offers the most favorable exchange rate without a spread (the spread is the difference between the rate of purchase and the rate of sale). Zamzam is creating a future, where people can access banking services quickly, safely and without intermediaries. The zam.exchange module is integrated into the zam.wallet multicurrency wallet (you can learn more about the zam.wallet here).

- Available exchange operations in zam.exchange include Fiat / Fiat, Cryptocurrency / Cryptocurrency, Fiat / Cryptocurrency, Cryptocurrency / Fiat.

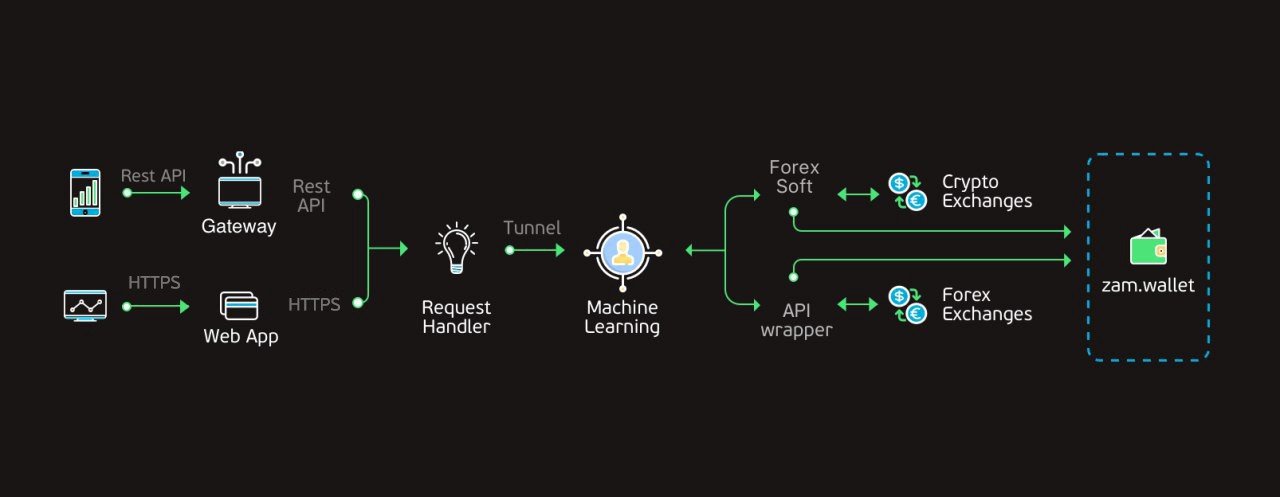

- How does the zam.exchange work?

- The Zam.exchange connects to the largest traditional forex trading platforms through a special software using the FIX protocol, the international standard for exchanging data between participants of exchange trades in real time. The Zam.exchange connects to most crypto exchanges through the open source Wrapper API, which was developed by the Zamzam team and allows users to automate the receipt of requests from exchange servers. The module is able to connect to the largest platforms by interacting with them through a single interface and preserving maximum performance, security and flexibility.

- The module works with Machine Learning with the following tasks:

- Analysis of user applications

- Monitoring of a set of cryptocurrency and forex exchanges, connected by API

- The Zam.exchange analyzes all user requests and selects the most profitable platforms for performing sales operations with the lowest price for the user. We will publish a separate Roadmap on how to use Machine Learning.

- Islamic Banking.

- Islamic banking is a financial system based on the principles of Shariah Law (legal Islamic provisions) and social justice, equal income distribution, and the prohibition of unjust enrichment and speculation. This definition might suggest that Islamic banking does have better responsiveness to clients’ interests than traditional banks. Integration with the cryptocurrency market has the ability to put it at the forefront of the modern banking sector. But first things first.

- We propose to discuss in details Islamic banking principles, correlate it to other banking models and analyze its implementation by zamzam.

- Is this a new era of financial relationships?

- Islamic banking is not so widespread, but is being actively developed. In 2016, the total assets for Islamic banking were estimated at roughly $1,9 trillion. At the same time, there are over 300 organizations doing business according to Islamic banking principles in more than 50 countries around the world. According to AlHuda-CIBE, the total volume of the Islamic financial market will reach $3 trillion by 2020, and its growth rate is definitely higher than that of the traditional banking sector. Anyway, in many Muslim countries it is so.

- The main differences from the Western banking system:

- Ban on paying interest

- Islamic banks do not charge interest (Riba) but they make money in other ways. The fact is, they become a partner in a business that is going to take a loan. There is no predetermined percent per loan that could be related to the value or other terms of lending. The bank analyzes a potential borrower’s business project and evaluates its perspectives. If the result is positive, then the bank becomes a partner of the borrower, thereby sharing the risk with the client, and makes agreements about splitting of business’ incomes. If a business fails, then both the bank and the client bear the losses. Thus, the bank acts as an investor.

- The principle of risk sharing and increased social responsibility of Islamic banking correspond to developing a new type of economy called the sharing economy.

- Preservation of agreements

- According to the principles of Shariah Law, the execution of contractual obligations is mandatory for all parties to a transaction. This rule reduces the risks for all participants.

- Environmental friendliness of financial activities

- Islamic banking prohibits speculation and financial support of trade in tobacco, alcohol, weapons, etc. Any gambling and derivatives are prohibited also, because they represent a major risk.

- The role of Blockchain

- Islamic banking and blockchain have a degree of convergence, as Islamic ideology is based on fairness and transparency that meet the principle of decentralization. Blockchain technology has great advantages that could be useful to the Islamic financial system. The most interesting part of blockchain is the smart contract that could contain the whole agreement between the Islamic bank and the borrower. Islamic banking could leverage these possibilities to enhance business processes and optimize operations due to the use of decentralized systems.

- The merger of these systems would play a crucial role in boosting the Islamic financial sector. For instance, it could modernize legal documentation, reduce transaction processing times and costs for providers, as well as transaction fees.

- zamzam and Islamic banking.

- The implementation of the Islamic financial system is realized by zamzam through the zamzam fund, which undertakes the support of young professionals and Muslim social infrastructure development as its main goals. The zamzam fund is controlled by 12 recognized Imams from all over the world.

- The main problems the fund aims to solve are:

- A crowdfunding platform for Islamic projects that will allow any person to represent a socially significant project approved by the Fund committee.

- -Education grants for young Muslim professionals in the best universities of the world.

- Building of mosques, hospitals and schools that are chosen by members of the Fund committee and ZAM Token holders.

- Organization of significant Muslim holidays.

Attracting patrons who have the opportunity to realize socially significant projects. - There is another way how zamzam could implement Islamic banking, one which demonstrates the ideology of the Islamic financial system. The fact is that the zamzam bank acquires movable and immovable property for a borrower who can be both an individual or legal entity, thereby sharing the risk. In turn, a borrower acquires movable or immovable property from zamzam by installments. The price of the property contains the bank’s reward. According to this approach, the zamzam bank provides a client with mortgage loans, loans for the purchase of goods, etc.

- zamzam is the first, or at least one of the first blockchain based projects implementing Islamic banking in the blockchain industry. This is an important step towards a big future, where a complex Islamic contract will be contained within a smart contract placed on the Blockchain.

- Zam.wallet how it works

- The Zam.wallet is a protected, multipurpose wallet with a user-friendly and functional interface.

- It plays a key role in the Zamzam ecosystem by serving entities.

- The main tasks of zam.wallet:

- Generation of necessary wallets (at first for cryptos and later for fiat money) and its safe storage

- Internal transfers between clients and withdrawal to external wallets

- Currency conversion by a separate module that is integrated with zam.wallet

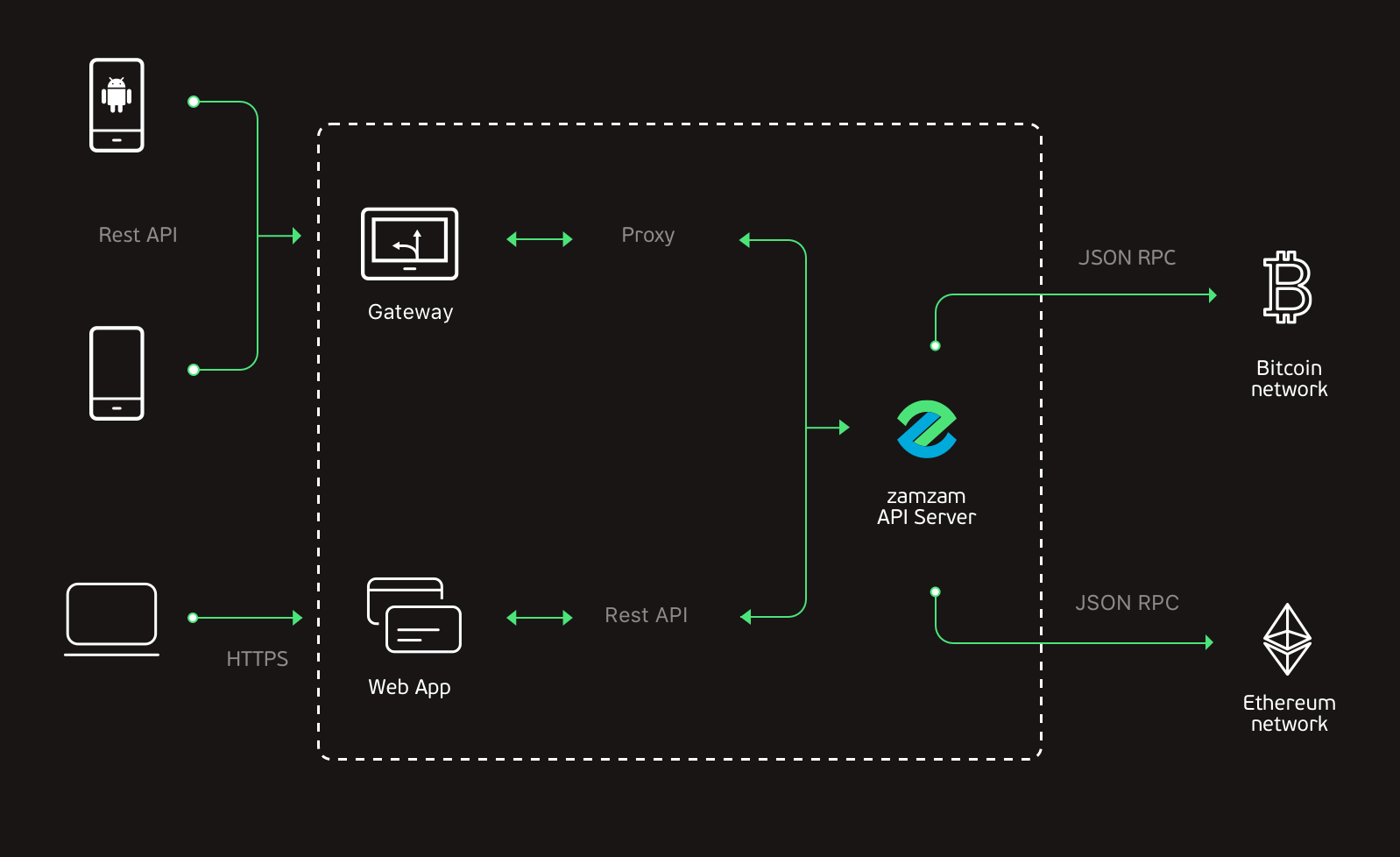

- How does it work?

- Zam.wallet can be used by users of Web, iOS and Android devices. During registration a user types in his phone number and password. The user generates additional wallets for needed currencies, as necessary. Encryption and decryption are provided only with user passwords.

- When sending a transfer, only a recipient’s phone number is needed. As an alternative, the user could specify a crypto wallet address. If a recipient has not yet registered in Zamzam database, a unique hash link is generated for such a user. The user gets an SMS that a current amount of money has been transferred to him and he has to register in the system to get them.

- What should a recipient do?

- Install the application or go to the website

- Register

- A recipient will find the funds in the User

- Account and can use them if the transfer amount is less than $200

- Pass the KYC procedure (later, if the transfer amount is more than $200)

- ZAM Token is the internal currency of the ZamZam Bank's blockchain, which is used to pay commissions for money transfers, purchases of ZamZam banking products, etc.ZAM token is a standard ERC-20 token. tokens are issued in the initially declared volume, additional release of tokens is not provided.

- Blockchain platform: Ethereum

- Token standard: ERC-20

- Power token: 8 500 000 000 ZAM

- Token face value: $ 0.02

- Total amount OF Zam tokens for sale: 65%| 5 525 000 000 ZAM | $ 110,500,00 at face value

- Soft cover: $ 11 100,000

- Hard cap: $ 55 400 000

- Accepted cryptocurrencies: ETH, BTC, LTC

- Private sale period: June 18-December 3

- Bonus for participants pre-sale: 35%

- Pre-sale period: October 22 to November 5

- Bonus for participants pre-sale: 25%

- The duration of the TokenSale: November 5, December 3

- More detailed information can be obtained from the technical documentation of the project or ask questions in the main forum thread.

- More info in:

- Web: https://zam.io/en

- Whitepaper: https://zam.io/ZamZam%20Whitepaper%20English%2020.08.18.pdf

- One-Pager: https://zam.io/ZamZam%20One-Pager%20English%2020.08.18.pdf

- Facebook: https://www.facebook.com/zamzambank

- Twitter: https://twitter.com/zamzambank

- Linkedin: https://www.linkedin.com/company/zamzambank/

- Join the discussion: https://t.me/zamzamchat

- Author’s Details :

- Fandaw2000

- Bitcointalk Profile Link :https://bitcointalk.org/index.php?action=profile;u=2368914

Comments

Post a Comment